In recent years, People in the us have spotted mortgage rates of interest plummet so you can historically low accounts, prompting of several homeowners so you can refinance their current mortgage loans. These re-finance fund serve to change homeowners’ newest mortgages with the fresh new financing and you will the newest words, often permitting them to secure lower rates plus cash-out on the house’s mainly based guarantee.

Which have rates beginning to climb up once again, not, someone else is curious if this sounds like still a good time to re-finance home loans – or if perhaps it will make significantly more feel to wait. Very, why don’t we evaluate where financial re-finance pricing currently remain. We will and falter how they usually have altered nowadays – and why a great refinance can still feel worthy of looking for.

If you believe you could take advantage of refinancing their home loan after that reach out to a mortgage top-notch now. Initiate saving money today prior to rates rise once again.

Just what financial re-finance pricing are

Considering studies on Federal Set-aside Lender from St. Louis, the common home loan interest at the beginning of try 6.66% towards the a 30-seasons repaired-speed loan.

If you’re home loan refinance pricing can differ a bit out-of home loan origination financing cost, these types of number tell you a pattern that’s standard across the board: a mortgage refi can cost you far more into the notice today than just it might features a year otherwise one or two before.

An elementary home loan loan are a repayment-created loan one runs either fifteen or three decades in length. Homeowners can decide ranging from a fixed or changeable rate of interest, and therefore determines exactly how much one to domestic get loan will surely cost him or her throughout you to fees.

In the event that sector rates changes between your time a loan is actually started (opened) of course, if its repaid, even in the event, it will have a tendency to make sense to same day payday loans no phone calls help you refinance the whole financing. It refi requires the place of your own fresh real estate loan financing, preferably that have less rate of interest and higher fees conditions.

Home loan refinance pricing from inside the peak of one’s pandemic

From inside the pandemic, rates with the home mortgages dropped into the reasonable numbers we have ever seen, after that spurring the fresh new influx of homebuying (and you will diminished business directory) that’s recently today start to slow. On these pricing bottomed out at just dos.65%.

That have interest rates which low, it only produced sense to possess a multitude out of home owners to help you dive at the chance of a mortgage refi. And of course, that’s what taken place. Based on analysis on Consumer Financing Defense Agency (CFPB), there are over 4 times as numerous re-finance funds began into the 2021 compared to 2018.

However, if you find yourself costs are no extended it lowest, of numerous home owners can still come across well worth inside refinancing their residence home loan finance now. Use the calculator below to help you crisis the newest numbers observe how you will be capable work with.

As to why mortgage refinancing remains worth looking for

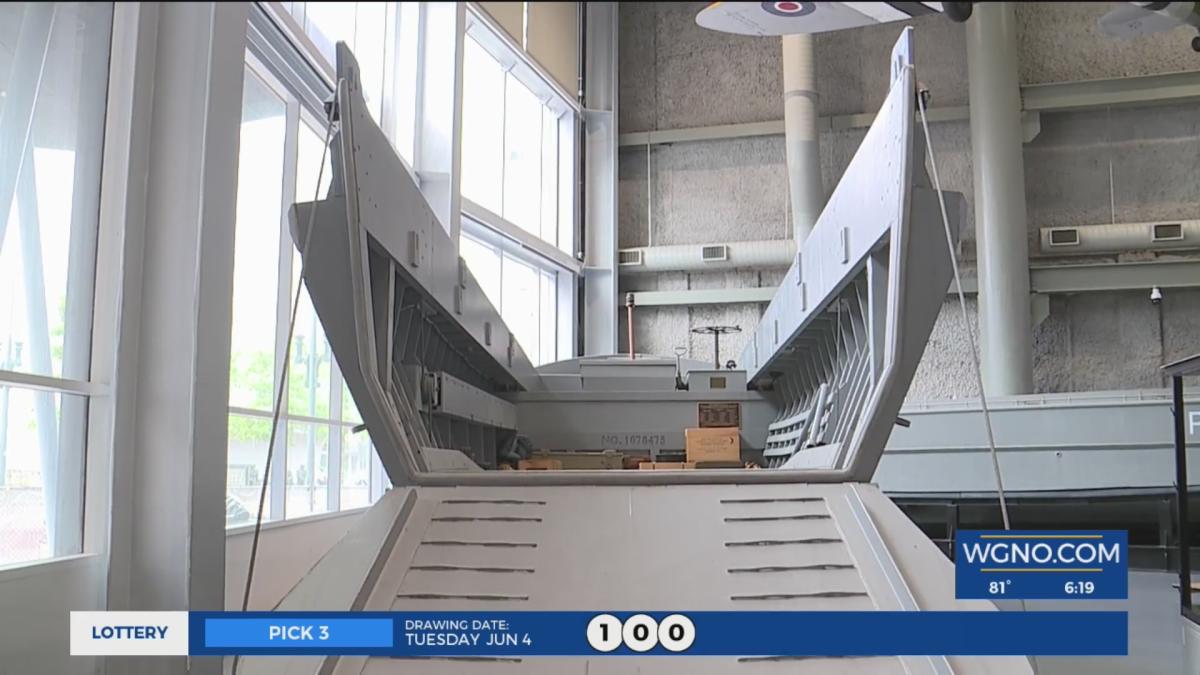

/cloudfront-us-east-1.images.arcpublishing.com/gray/QZYGSVVIR5LGTCCQWNLEQ62KEY.png)

But not, you will need to remember that refinancing mortgage financing can still getting a wise financial decision today. At all, when you are home loan costs is large today than simply these people were within the 2020-2021, he’s nevertheless low from the historical requirements.

Around 2000, an average mortgage rate of interest reached a peak from 8.64%. On the middle-eighties homeowners noticed costs of up to %. During the 1981 costs had been resting whatsoever-big date highs of %.

After your day, the choice to refinance a mortgage loan depends on your specific loan conditions and wants. When the the present costs was lower than you will be spending on an existing mortgage, refinancing could potentially save you a fortune within the desire, drop their payment per month, get the household paid back shorter, or the three.

The objective of a beneficial re-finance isn’t limited to lowering your focus price, either. Residents can also use a money-aside refinance to pull from their home’s collateral, particularly if they are able to protect an aggressive rate. So it money are often used to pay off obligations, loans a house recovery, or security highest costs like expenses or a wedding.

No-one knows what rates of interest is going to do moving forward, otherwise exactly how high they climb up. If you are thinking about refinancing their home loan, local plumber to achieve this can still become now.

Sex Cams English

English Deutsch

Deutsch Français

Français Italiano

Italiano